Comprehensive Trade Data

Built around your tariff classification

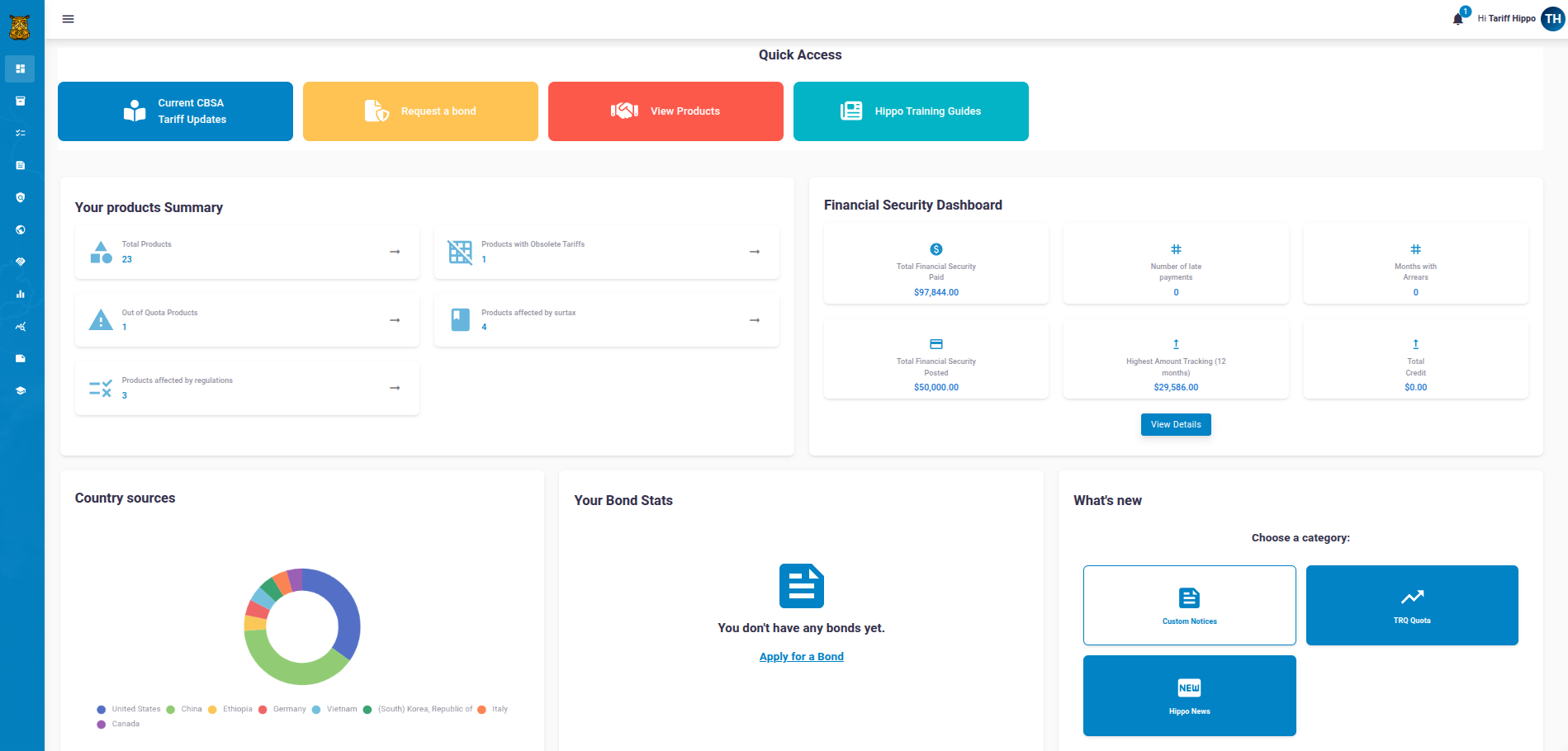

It is the most intuitive platform for managing your products, compliance, and CBSA financial security in one place, One platform.One source of truth.

Explore Tariff Hippo

See how Tariff Hippo simplifies import compliance in real time.

Comprehensive Product Database Controls

Manage your import portfolio from one centralized system

- Centralized product database with tariff classification, import permits, rulings, compliance requirements and FTA eligibility

- Powerful filters to instantly identify updates, surtax, Country of Pour and Melt (COMP), CBSA changes and more

- Easy import/export tools for faster data management

Stay on top of Surtaxes and Steel Quotas

Compliance intelligence that keeps pace with change.

- Instantly identify surtax impacts with the Tariff Hippo Surtax Search Grid

- Surface remission opportunities directly within your database

- Track and manage steel quotas in real time

- Receive live product updates and proactive alerts

Financial Security & CARM Visibility

Protect your cashflow and RPP privileges

- Purchase and manage D120 import e-bond, NRI GST bonds, appeals bonds in one place

- Easily update financial security levels as your business changes or CBSA evolve

- Real-time visibility into CARM exposure, payment obligations, and risk through the Financial Security Dashboard

- Proactive tools and alerts to help prevent RPP interruptions before they happen

Trade Forms, Resources & Import Tools

Practical tools to support daily trade operations

- Generate Canada Customs Invoices (CCI) or required Free Trade (FTA) documents directly from your product database

- Access quick-reference resources and links for global trade compliance

- CARM Campus – practical guidance for navigating CARM requirements

- Integrated trade tools including Global Affairs(GAC) resources, Customs Notices, Incoterms, VFD codes, free trade data, forms and more

Flexible pricing plans

bronze

An essential tool for sales teams, carriers, and freight forwarders—perfect for onsite visits or when you need instant answers at your fingertips

- Financial Security & RPP Information

- Country of Pour & Melt

- Surtax Search

- U.S trade war Filters

- Trade Policy Updates & Notices

- PGA information

- FTA information

silver

Essential features that enhance internal compliance tools for products with minimal import controls, with accessible forms and trade information

- All Bronze Features +

- Up to $10,000 Importer Bond

- Up to 150 Product Database SKUS

- Notifications

- FTA and CCI Forms (Max of 5)

- Tariff Trade Notes

- Trade Priorities

- Customs Notices

- D Memos

gold

A comprehensive suite of information and controls designed to maximize oversight of your import trade data while minimizing risk exposure

- All Silver and Bronze Features +

- Up to $50,000 Importer Bond

- Up 25,000 Product Database SKUS

- Direct Notifications

- Access to Purchase Additional Bonds

- Database Import

- Additional Users

- CITT & TRQ

- SIMA Matching

- ADD/CVD tracking

- Quota

- Coming Soon - Financial Security Dashboard

Unsure which option is right for you? Click below to learn more.

Frequently Asked Questions

Can I use the same part number for different origins?

Yes. You can assign the same part number to multiple countries of origin so Tariff Hippo can capture and apply accurate compliance, tariff, and trade data based on origin. In fact, Tariff Hippo works most effectively when origins are clearly listed,helping ensure the most accurate trade intelligence and compliance results.

How frequently is Tariff Hippo updated?

Tariff Hippo is updated continuously based on changes affecting Canadian trade and compliance. Update frequency varies by industry and activity levels and may occur daily or even multiple times per day.In most cases, legislative changes, surtaxes, trade priorities, and Customs Notices are reflected within 6–12 hours, and often within the hour

Important Notice Regarding Bond Applications

If you are applying for a bond through Tariff Hippo, please note the following:

The Canada Border Services Agency (CBSA) requires financial security to be posted directly by the importer, along with an explicit consent agreement signed by the importer.

To support transparency and compliance, service providers - including customs brokers, freight forwarders, and consultants may assist with requesting financial security on behalf of an importer; however, the explicit consent agreement must be signed directly by the importer and cannot be electronically signed by a third party.

Start your journey below

Trusted by Canadian importers

Help others make confident trade decisions by sharing your experience with Tariff Hippo.

Tariff Hippo

Tariff Hippo